My past several marketing columns emphasized the value of market research – in-office and in-person research in the marketplace – for quality golf course marketing planning. Neither is complete without the other, but in-person research tells you what’s actually occurring in your market. There’s no substitute for “on the ground” research.

All the formulas for golf market research – participation rates, state annual rounds, adjustments for age and income, etc. – will give you a snapshot of what, most likely, is occurring in the market. And, it’s quality information, which is a product of many years of golf industry research by the National Golf Foundation, the Sporting Goods Manufacturers Association, Pellucid Corp. and others.

However, when it comes to planning real-life golf course marketing, golf course managers should want this theoretical or in-house research along with in-person market research before they start projecting priority business segments and allocating budget money to them. Although course managers prioritize incorrectly occasionally, you want your best shot at being right with marketing plan priorities the first time through.

If you’ve followed my column the past few months, you’re capable of identifying and collecting valuable market research for your course to help you create a meaningful marketing plan that’ll generate incremental rounds and revenue. After a few calls from readers apparently trying to follow my market research columns, eventually, you come across a unique market where you have to ask, “So, what if …”

What if you’re in a market where the available in-office market research and the in-person market research are so divergent that golf demand for the marketplace doesn’t make sense?

For example, seven or eight years ago I was trying to help an industry friend better understand his market, Jacksonville, Fla. The first thing I did was conduct a golf rounds demand analysis. I wanted to look closely at where his greatest opportunities for public play would come from, so I researched a five-, 10- and 20-mile radius from his course. In a five-mile radius, consumer golf demand ranged from 16,500 rounds to 21,900 rounds per 18-hole equivalent. In a 10-mile radius, consumer golf demand ranged from 72,800 rounds to 91,000 rounds per 18-hole equivalent. “That can’t be! It’s highly unlikely,” I thought. In a 20-mile radius, consumer golf demand ranged from 87,300 rounds to 110,400 rounds per 18-hole equivalent. “I don’t think so! Jacksonville?” I thought.

I called the company I bought the demographics package from and asked if there could have been a mistake in the population numbers it gave me. It double-checked, and its population statistics were correct. Confused, I called another consultant – one with more years of consumer market research experience at the time. Stuart Lindsay of Edgehill Consulting looked at my consumer demand analysis then looked at the raw population figures. He followed my calculations and demand adjustments and stated quite comfortably: “The five-mile radius is probably representative, but the 10-mile and 20-mile radii are population anomalies. When you visit, check your golfer participation rate. It’s probably very low in that particular area of Jacksonville.”

Lindsay was correct. My point is there are many types of market research, and not all of them will be accurately revealing about a golf market.

Lindsay shared another market with research aberrations unique to it – Las Vegas.

“They’ve got 39 million visitors from all over the country, and 9 percent (the national golf participation rate) of those probably play golf. But the Las Vegas Visitors and Convention Bureau states 2 percent of those 39 million play almost 800,000 rounds while they’re there. What that number really says is that only about 25 percent of the golfers visiting actually play golf, or the demographics of the typical Las Vegas visitor don’t match those of the typical golfers. It’s what we call a cultural anomaly. In a nontourist area, we then look at income, age and ethnicity for a possible explanation. If that doesn’t work, we usually repeat the following advice:

1. There’s no substitute for actual “on the ground” market reconnaissance.

2. Place more belief in the rounds information personally obtained from courses in the area.

3. Use those round averages to extrapolate actual golf demand in the area.

So, in the aforementioned Jacksonville example, one should follow this advice to figure out why all those missing golfers are doing something instead of golfing. The same advice can be used in the Las Vegas market as well.

The bottom line is that you should conduct all the market research available to you. Always remember the most important element of market research is the correct interpretation of the data and information for the benefit of your facility. Keep asking: “So, what if …” The answers will follow. GCI

Jack Brennan founded Paladin Golf Marketing in Plant City, Fla., to assist golf course owners and managers with successful marketing. He can be reached at jackbrennan@tampabay.rr.com.

Explore the April 2008 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

- Applications open for 2025 Syngenta Business Institute

- Smart Greens Episode 1: Welcome to the digital agronomy era

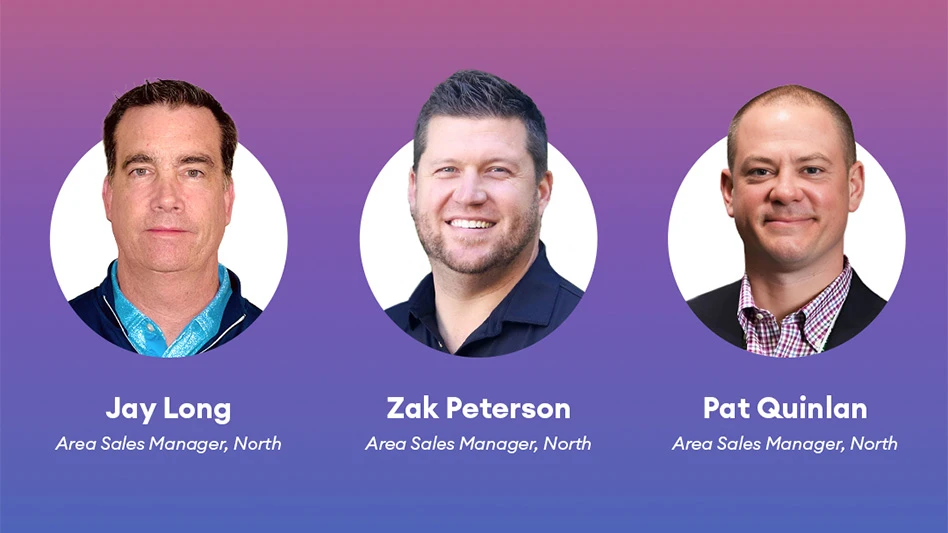

- PBI-Gordon promotes Jeff Marvin

- USGA investing $1 million into Western Pennsylvania public golf

- KemperSports taps new strategy EVP

- Audubon International marks Earth Day in growth mode

- Editor’s notebook: Do your part

- Greens with Envy 66: A Southern spring road trip