What’s with the brouhaha between the New York Times article “More Americans are giving up golf,” (Feb. 21) and the editorial response from Mike Hughes, c.e.o. of the National Golf Course Owners Association, in the April issue of Golf Business challenging the Times’ negative opinion about the golf industry’s health?

I received an e-mail copy of the Times article the same day it ran. It was sent to me by a course owner, who was one of the sources in the article. He was shocked and dismayed by its negativity. Call me a sensationalist, but after I read it, I agreed with the author’s underlying basis for the negative headline.

| SAMPLE SURVEY |

Visit www.golfcoursemarketingplans.com for a downloadadable form, available for 45 days starting July 15. |

The author uses many statistics attributed to the National Golf Foundation. I’m not saying the statistics are wrong, though they might be dated or inaccurate. Nonetheless, the author’s forecast was negative. He came to the conclusion that the problem isn’t a game of golf; it’s the game of golf itself: “Over the past decade, the leisure activity most associated with corporate success in America has been in a kind of recession.” Hmmm. I thought the leisure activity most associated with corporate success in America was cigar smoking and martini drinking. But I digress.

The author even sourced Jim Kass, research director for the NGF, who used the term “doom and gloom” when asked what was keeping people from taking up the game, and golfers from playing more. Oops. Seems that quote steepened the author’s apparent negative slope.

We have two different perspectives about the health of the industry – doom-and-gloom on the one hand and rose-colored glasses on the other. Considering those two views – both correct in my opinion – here’s a marketing suggestion: Don’t dwell on the state of the industry. Rather, dwell on the state of your golf business. You can help make the industry better by making your golf business healthier. And two easy-to-implement marketing elements to help monitor your business are play trends and player surveys.

As owners, managers and operators, it’s meaningful to understand the trends in the industry, but don’t you care more about what’s happening at your course, in your market? How many rounds are being played at your course versus your competitors, and why? Whether rounds have increased or decreased, you need to know why a market trend is occurring at your course.

One section of my company’s course marketing plan is called a calendarized revenue plan. Calendarized means incorporating your rounds and revenue projections into each month of the year, even weekly, if you can. The marketing secret to these projections is that they’re not right or wrong. You don’t live and die by these numbers. You learn from them. Doing so, you’ll begin to understand your market better. Whenever you miss your calendarized revenue plan, ask why you missed the projection and investigate the reasons. Learn why, and you’ll be able to project that month’s rounds more accurately next year.

For those operators who monitor player surveys, how consistently do you monitor them? Too often can be bothersome to golfers and not often enough is almost meaningless. Current, meaningful insight about players – their habits and likes and dislikes about your course and golf market – can be gathered effectively once a quarter. The manager should schedule a survey week in each quarter of the year. The survey should be handed out for seven consecutive days, preferably 10, to be representative of all play segments patronizing the course. The most difficult part of organizing a player survey for owners and managers is knowing which questions to ask and how many questions to include. (And example survey can be found online. See box below.)

The manager should determine an effective, appropriate incentive (e.g., a free beverage) to give the customer for filling out the survey and returning it. The returns on this type of a survey are low – 5 to 10 percent – so it’s important for the entire staff to encourage customers to fill them out.

As surveys are handed out, the atmosphere should be friendly. You’re asking customers to do you a favor, so you need to make sure they realize the information is important and meaningful to your operation and service to them.

The favorable results should be posted the week after the survey. Research information should be used as a barometer to gauge real and/or perceived problems that might need to be addressed within the marketplace. The first few surveys will provide bare market insight. However, with the compilation of repeated surveys, you’ll begin to see meaningful results about who’s playing the course and why. This information will go a long way to help you better market your course. GCI

Jack Brennan founded Paladin Golf Marketing in Plant City, Fla., to assist golf course owners and managers with successful marketing. He can be reached at jackbrennan@tampabay.rr.com.

Explore the June 2008 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

- Smart Greens Episode 1: Welcome to the digital agronomy era

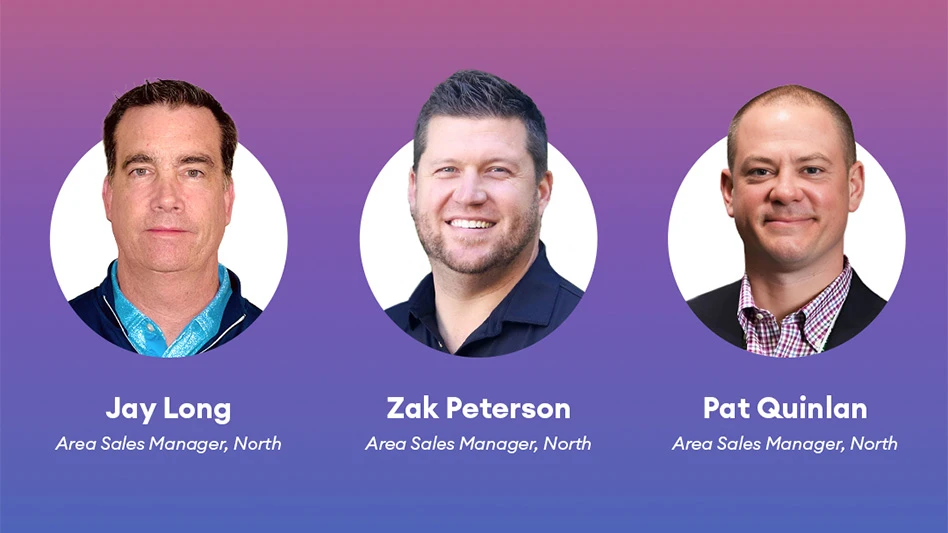

- PBI-Gordon promotes Jeff Marvin

- USGA investing $1 million into Western Pennsylvania public golf

- KemperSports taps new strategy EVP

- Audubon International marks Earth Day in growth mode

- Editor’s notebook: Do your part

- Greens with Envy 66: A Southern spring road trip

- GCSAA’s Rounds 4 Research auction begins