Adobe Stock

Some golf course superintendents thrive on routine.

Wake up at the same time every day. Eat the same breakfast. Drive the same pickup truck to the same parking space in the same parking lot next to the same maintenance facility. Work the same hours. Every day is a little different, of course, but the overarching structure of the day remains the same.

Scott Rohflsen prefers variety.

“I’ve never had a 9-to-5 job,” Rohflsen says. “Just get the job done and move on, you know? That’s the way I look at it.”

That sort of workday has worked for Rohlfsen for more than 20 years as the superintendent for a passel of 9-hole golf courses across Iowa. He has worked for more than one course constantly since 2007. He has worked for five courses since 2018. Rohlfsen once worked for each course, but his entrepreneurial spirit kicked in hard about seven years ago when he formally launched Rohlfsen Golf, LLC, and he now handles each course as an independent contractor.

“I’m the superintendent of the golf course, but I’m not an employee of the golf course. It’s just kind of a unique situation,” Rohlfsen says. “I had wanted to do it for a long time, but after talking to the golf courses where I worked, because I was just their employee, they could just pay me gross wages and not have to do employee taxes and stuff like that. I have to pay my own liability insurance, which is really cheap, like $300 a year, and, because I’m not an employee, I have to carry my own pesticide applicator’s license.”

Setting up his LLC cost Rohlfsen about $600. He made the move “mostly for tax purposes,” he says. “It just made it easier to say I have this corporation, and then I could file tax write-offs on my mileage. It just got messy to be an employee of each course.” (One tax pro tip: When you’re self-employed, you need to pay income taxes quarterly rather than annually. “You have to remember you owe taxes,” Rohlfsen says. “People get so excited when they get refunds. It was your money already! They’re just giving it back to you!”)

The logistics of managing five different courses with five different ownerships is complicated, but Rohlfsen manages everything easily enough in his head. He works with a team of about 30 — with none working on more than one course — most of whom handle one job per day. He sends out schedules for the week ahead on Sunday nights. And he does all this, incredibly, without spreadsheets. “I don’t do spreadsheets,” he says. “I wish I did, I always liked spreadsheets, but I just don’t have time.”

He also travels from course to course, normally at least three stops every day, not in a pickup truck but in a Nissan Sentra. Most of his miles are on sparsely traveled two-lane roads with few stop signs and fewer traffic lights, and he regularly tops 40 miles per gallon. He also trades in every two or three years to avoid the maintenance requirements that tend to pile up after 60,000 miles. “It’s a very in-demand car around here,” Rohflsen says with a laugh. “Seems like everybody drives a Nissan.”

Perhaps the biggest professional perk for Rohlfsen Golf, LLC, is trimming each of his five annual maintenance budgets by being able to purchase directly from suppliers at a discount. Buy more, save more — and even more on top of that by buying most of his product via EOPs.

Rohlfsen has explored switching his LLC to an S corporation — LLCs, or limited liability corporations are better for maximizing flexibility in how business are run, while S corps are better for smaller corporations and allow only for a certain number of shareholders — but the move didn’t make financial sense because he doesn’t purchase large equipment. He uses and maintains equipment owned by and housed at each of the five courses. “It’s more involved and it just doesn’t seem worth it,” he says. “It might have saved me $500. If I actually owned equipment, it would be a no-brainer.”

Right now, Rohlfsen has no plans to build out and bring in other employees, but “the framework is there for expansion if needed, if I want to. But everything’s pretty cozy right now.

“Ultimately, it’s just a good feeling to know I got my own company. It looks nice to say you have a company. It’s not just Scott from Willow Run Country Club.”

Matt LaWell is Golf Course Industry’s managing editor.

Latest from Golf Course Industry

- From the publisher’s pen: Technology diffusion and turf

- Applications open for 2025 Syngenta Business Institute

- Smart Greens Episode 1: Welcome to the digital agronomy era

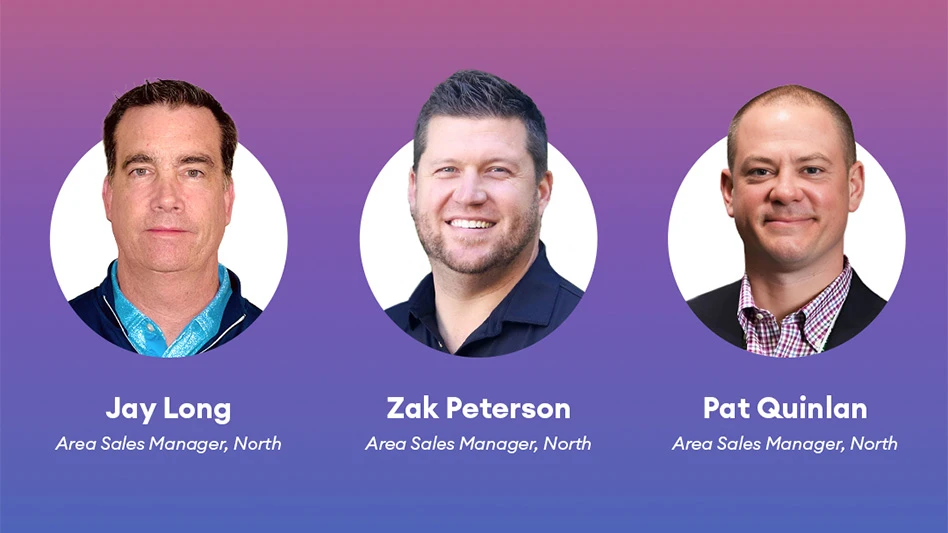

- PBI-Gordon promotes Jeff Marvin

- USGA investing $1 million into Western Pennsylvania public golf

- KemperSports taps new strategy EVP

- Audubon International marks Earth Day in growth mode

- Editor’s notebook: Do your part