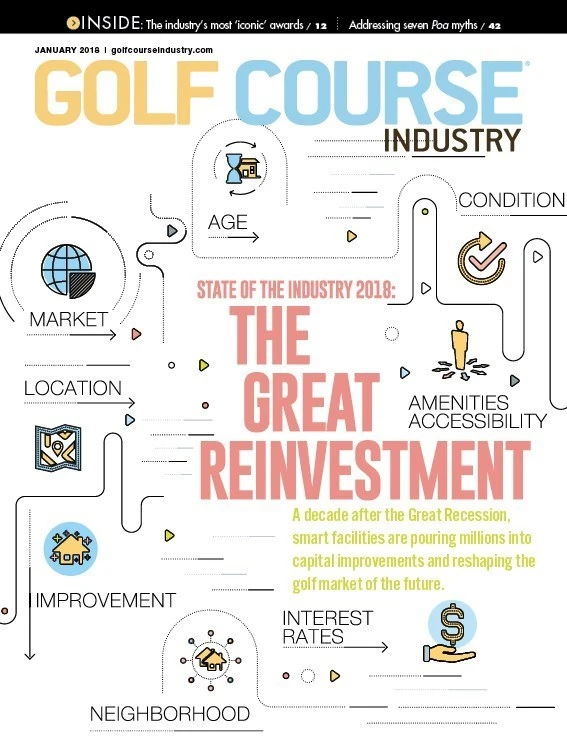

As we put this year’s State of the Industry issue together and took a long, hard look at the data, we debated about how to summarize what we found as a big headline for our cover illustration.

Was it fair to say that, “The Golf Business is Back?” I rejected this one because I hate the notion that our business is getting “back” to a fake boom time when a lot of awful decisions got made. It also reminds me of the current golf media obsession with Tiger being “back.” Puh-leeze! Can’t we just run our business like a business without relying on the return of Eldrick “The Messiah” Woods to succeed?

Was it more accurate to say that, “We’re Getting Healthier?” Well, that’s true too but it doesn’t tell the whole story. It’s unquestionable that industry suppliers have been pleasantly surprised with sales in a “slumping” golf market the past few years and the number of courses closing has held steady at about 175 a year, but that’s not “health” in the traditional sense of growth and expansion.

Should we stick with, “The Building Boom Continues?” Duh. We’d just be telling you what you already know, although I think the information we developed – along with the study done by our friends at the ASGCA – provides a new level of insight into what kind of remodeling is being done and why.

So, those possible summary statements are true, but we went with “The Great Reinvestment” as the truest appraisal of the state of golf in 2018 for a bunch of reasons.

First, it’s undeniable that we’re in the midst of the biggest remodeling boom in golf history. It’s finally occurred to everyone that courses must change and improve to compete.

Second, the amount of money being spent in a “flat” market is astounding when you total it all up. A couple of billion dollars a year is being poured into improving bunkers, recontouring greens, fixing nagging drainage problems or the soup-to-nuts redesigns and restorations we’re seeing at the highest end of the business. Finally, since it’s not about getting “back” to the old days, it must be about reinventing golf for the future. That’s what we’re seeing now.

I won’t lie … the Great Reinvestment will not be a rising tide that lifts all boats and magically solve golf’s broader systemic problems (time, perceptions, women, kids, etc.). Instead, it’s going to further separate the Haves and the Have Nots in our industry. The U.S. simply can’t support 15,000 golf courses. The fact that smart operators are investing and giving picky golfers a better product will doom a lot of stale, badly run facilities that have been limping along for years.

The divide is going to widen into a chasm and many small, underfunded operations won’t be able to cope with the competition and the inevitable, grinding rise of labor costs. In the future, there will be two kinds of golf courses: those that manage labor costs effectively and those that become condo complexes.

That said, I’m heartened by the willingness of thousands of courses around the country to reinvest now to ensure better futures decades from now. That’s both farsighted and a sign that banks have regained some confidence in our happy little industry. Sure, many clubs are self-financing their renovations, but others have borrowed. That could not have happened five years ago.

I guess I’ll pat myself on the back for years of saying that a “smaller, smarter golf market is emerging.” What I didn’t see coming was how aggressively operators are investing in that scenario. They see, at the local level, opportunities not just to survive, but to thrive. In fact, a bunch of them are just kicking ass right now. A surprising number of clubs are posting astonishing profits (“excess revenues”) these days and there’s no reason to think that will change absent some catastrophic event that will make us all forget about golf’s petty problems.

So, here we are nearly a decade after our generation’s Great Recession, and instead of talking about the death of golf, we find that we’re in the midst of the Great Reinvestment. Golf is finally getting smart and supply and demand will even out over the next decade. We’re incredibly fortunate in many ways that we didn’t kill our own industry with stupidity and overbuilding (though we tried). Now it’s up to us to steward the business of golf the same way you steward your property … intelligently and always with an eye on the long term.

Here’s wishing you an awesome 2018 … and a bright future for all of us.

Explore the January 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

- Toro continues support of National Mayor’s Challenge for Water Conservation

- A different kind of long distance

- Golf Construction Conversations: Stephen Hope

- EnP welcomes new sales manager

- DLF opening centers in Oregon, Ontario

- Buffalo Turbine unveils battery-powered debris blower

- Beyond the Page 66: Keep looking up

- SePRO hires new technical specialist