As 2019 dawns and we examine the state of the industry, it seems like a good time to shine up the old crystal ball for a glimpse of the future. (Be advised this is the same crystal ball that said East Coast private clubs were recession-proof in 2008 so all predictions should be taken with a large grain of salt.)

That said, Jonesy’s Magic Crystal Futurama Ball Reveals …

The golf market will continue to shrink. There’s no reason to think the current slow deflation of the supply of U.S. courses will stop. Sure, we’re still building a few fabulous new courses every year, but we’re annually closing or converting 200 or so that just can’t compete because of overbuilding, debt, bad management or failure to invest in good conditions.

The current remodeling trend will further reshape our industry. Smart facilities – mostly private clubs and high-value resorts and semi-privates – are investing now to ensure they can compete in 10, 20 or even 50 years. Golf still has strong appeal and experts like our friend, Henry DeLozier, believe the future is bright for private clubs. But you must offer today’s customers something fresh, appealing and fun. A zillion trees, worn-out practice areas, and stupid rules about collared shirts and music on the course ain’t gonna cut it. As we’ve said before, the future belongs to those who adapt and change. Jeez, even the blue blazers at the stodgy old USGA simplified a bunch of rules in the past year. Can’t we all evolve a little?

The fixer-upper boom that’s being driven by bunkers, regrassing and full or partial renovations is about halfway over. Builders and architects (particularly regional folks doing master plans) are still extremely busy, but in another seven or eight years, the courses that are going to invest will have done so. At that point, we’ll settle into the next new golf market.

The new market will be smaller but healthier and more hospitality driven. A decade from now we’ll have about 13,000 courses (vs. about 15,000 today). The winners in 2029 will be clubs and facilities offering a fresh new golf product combined with fitness, classes, and other activities that attract more women and families. You simply cannot expect to succeed in the future by offering the same crap. What’s the average age of your member or customer? Is it over 50? If so, you’re screwed if you don’t act soon to attract a new, younger and more diverse customer base.

From a supplier standpoint, the market 10 years from now will be even more stratified than we see today. Currently, the top 20 percent of courses account for about 60 percent of all spending. I think it will feel more like 75 percent in future as labor costs grow and make it even more difficult for facilities in the bottom half of the market to maintain current spending levels or invest in infrastructure. That said, the profitability we’re seeing today at top clubs and high-end daily fees suggests the overall golf market will continue modest growth despite closures at the low-end.

A lot of amenity courses built in the ’80s and ’90s as housing anchors will struggle and fail in the next decade. It’s a bad business model because they don’t have enough play within the development to support the course and few ever attract much outside public play because the perception is they are private and expensive. Homeowners around these courses are starting to reject the idea of paying exorbitant HOA fees to maintain a course they don’t use. Hard to blame them.

The result of that will be a mini-boom in the business of shutting down failed courses and turning them into greenspace, hiking trails or other recreation areas. There’s an entire industry waiting for smart people who figure out how to repurpose these courses that simply can’t be turned into more housing.

Maintenance will be reshaped by labor costs. Again, this will be a story of haves and have-nots. The haves – 5,000 or so top facilities – will solve problems by hiring the appropriate number of people and employing the lion’s share of the shrinking number of kids coming out of traditional four-year turf programs. The have-nots will struggle, discount green fees and further reduce investments in the property. Not good.

Yes, there will be more robotic mowers (and probably “bunker roombas” that rake sand). It’s inevitable. Again, we’re not replacing workers with robots, we’re focusing trained humans on important stuff and letting the machines do simple, repeatable tasks.

Lastly, I’m not saying that superintendents will rule the world in 2029, but in a future that demands sustainable urban greenspaces, supers will be pretty damned important. After all, you manage the asset that matters – the big, living, breathing green thing that attracts and inspires so many people. Because of that, your future looks very bright indeed.

Explore the January 2019 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

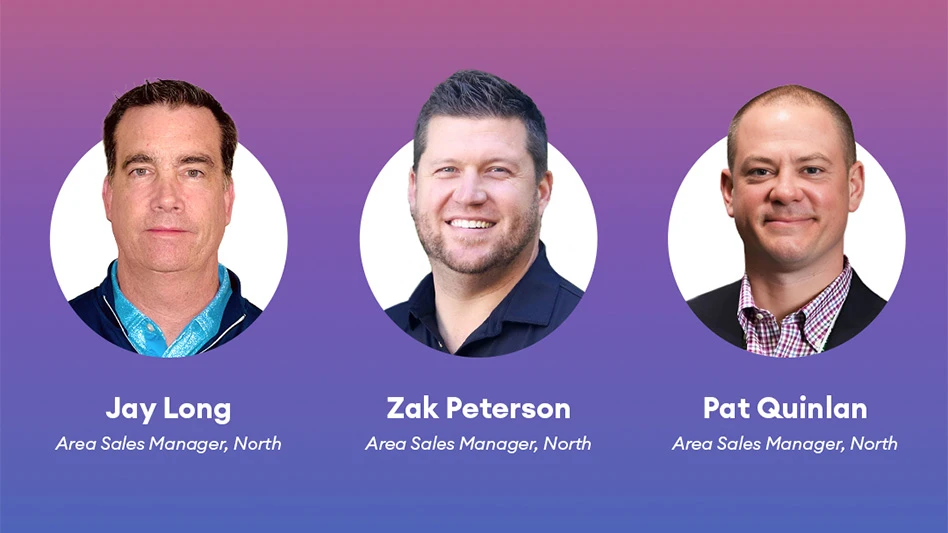

- PBI-Gordon promotes Jeff Marvin

- USGA investing $1 million into Western Pennsylvania public golf

- KemperSports taps new strategy EVP

- Audubon International marks Earth Day in growth mode

- Editor’s notebook: Do your part

- Greens with Envy 66: A Southern spring road trip

- GCSAA’s Rounds 4 Research auction begins

- Quali-Pro hires new technical services manager