Pat Jones Pat JonesEditorial Director and Publisher |

Last month I outlined my bucket list for our industry – the things I hoped we’d achieve in my lifetime – and asked readers to tell me theirs. I received several emails with good golf business suggestions. The one that really struck me came from an old friend on the supplier side that said: “You know what’s on my bucket list? I hope I live to see the day when customers actually do support the companies that support their profession.” Whoa! This is a guy who’s spent a career directing marketing dollars for an important industry company who made nearly every investment decision thinking, “What’s the right thing to do to support my customers?” His first thought, beyond running a good business, was about how he could be loyal to you and provide you with opportunities for education, information and other things you needed to grow. Now, he really questions whether his customers appreciate that commitment or whether it’s just lip service. I agree with him. There’s a disconnect between what you say about how you support companies committed to the industry and your actual buying habits. This isn’t a new phenomenon. Here’s part of a rant I wrote about this subject in this space a few years back: The companies that reinvest in our business and your profession are getting slammed by the carpetbaggers, and, quite simply, they can’t be expected to take it forever. Nor can they be expected to invest even more to bring new products to the market, conduct research to help you use products better, hire first-class sales reps or sponsor the numerous educational and social opportunities we’ve all come to enjoy. Let’s be clear: Good companies won’t continue to value this market unless you value them. I would love to provide a list of the good guys and bad guys in print, but the nice lawyers at Golf Course Industry would probably be very unhappy with me. Instead, let me offer a quick quiz to help you sort things out as you plan your purchasing for 2008: 1. Does the company have a name you know and trust? (+10 points) 2. You’ve never heard of the company, and you couldn’t spell their name if you tried. (-10 points) 3. Is their sales rep someone you’ve known for years who has demonstrated good agronomic knowledge and who has served you and your friends well even when he wasn’t trying to sell you something? (+10 points) 4. The sales rep is a guy whose last job involved selling ink-jet cartridges… and he wasn’t particularly good at that. (-10 points) 5. Does the company support your educational needs by sponsoring events, participating in your chapter and advertising in industry journals? (+10 points) 6. Is the company’s idea of industry support bringing along some donuts for an unscheduled call by their salesman? (-10 points) 7. Does the company work with a solid local distributor that has a reputation for honesty and quality? (+10 points) 8. The company claims they “don’t need no stinkin’ distributor” taking a cut so they can give you lower pricing? (-10 points) 9. You’re almost always willing to try new products and services from the company because it has a good track record. (+10 points) 10. You have to gulp real hard when it occurs to you you’re risking your greens – and your job – to save a few hundred bucks on a case of product. (-10 points).

In 2007, choosing alternative products based solely on price might have made it harder for companies to justify the fairly lavish marketing money spent on customer entertainment, big feel-good sponsorships or discretionary stuff like logo golf balls for chapter tournaments. Today, that choice could impact whether the company continues to invest in R&D to bring you new products. It could tip the scales against continuing to support educational conferences and trade shows (which are the economic engine that drives many associations). It may force them to reduce advertising spending (bye-bye free information from trade journals). It could eliminate trusted salespeople you’ve relied on for technical help. For many of the companies which – like my bucket-list friend – have been stalwart supporters of your professional and educational needs, it’s tougher to justify those investments when they continue to lose market share to competitors who don’t. Every time a super chooses a cheaper alternative from a company that doesn’t reinvest back into the business, it’s not that painful. It’s like getting a little cut on your finger that bleeds just a bit. Hardly life-threatening. But, multiply that across the market and over years and pretty soon it becomes death by a thousand tiny cuts. Small choices matter. Choose wisely. |

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

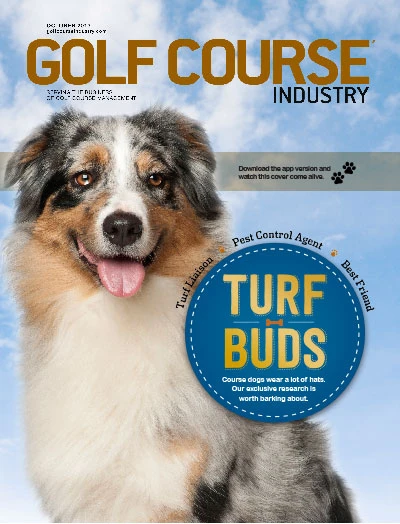

Explore the October 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

- Advanced Turf Solutions’ Scott Lund expands role

- South Carolina’s Tidewater Golf Club completes renovation project

- SePRO to host webinar on plant growth regulators

- Turfco introduces riding applicator

- From the publisher’s pen: The golf guilt trip

- Bob Farren lands Carolinas GCSA highest honor

- Architect Brian Curley breaks ground on new First Tee venue

- Turfco unveils new fairway topdresser and material handler