Government-run golf courses may be about as popular as death and taxes among the private operators who are forced to compete with them, but they are just as inevitable. And, in these tough times, they may even outperform comparable facilities.

The question is, so what’s fair on the fairways?

Some industry insiders, especially owners of public courses, question whether municipalities should be operating golf facilities while struggling with shrinking budgets and escalating costs. Others, though, argue that municipal golf is every bit as viable as its public and private counterparts and is a necessary component for the growth of the game.

Municipal golf has been around for a long time, says National Golf Foundation (NGF) President and CEO Joe Beditz, and it plays an important role in the overall mix of supply in the United States. Municipal courses fill a need for millions of less-affluent golfers who enjoy not only the game, but its affordability through a government-owned venue. Eliminate that price point afforded at these facilities and those players will cease to play, Beditz says.

“If you removed that price point and took all of the munis out of business, do you think the public courses would lower their fees? No,” he says. “And that would reduce the demand for golf. Therefore, overall rounds played and consumption in golf would decline.”

Despite the recent economic downturn and subsequent slow recovery, Mark Woodward, CGCS, CEO of the Golf Course Superintendents Association of America (GCSAA) believes it is a prime time for municipal courses to stay in the business. And Woodward is no stranger to municipal operations. He worked for the city of Mesa, Ariz., for 31 years and at the famed Torrey Pines in San Diego for three years.

“Municipal golf provides an avenue for people to begin the game, whether they are juniors, ladies or just beginning golfers,” Woodward says. “We want more golfers to get into the game, so I would hope municipalities hang in there and try to operate their golf courses as much like a business as they can and yet provide affordable, accessible golf for the vast majority of people who want to begin the game.”

Ted Horton, CGCS, of Ted Horton Consulting of Canyon Lake, Calif., says municipal courses are probably the only large open spaces within communities that pay for themselves.

“I don’t know of any park lands, any football fields, any baseball diamonds that can pay their way,” says the former vice president of resource management at Pebble Beach for nine years and the interim general manager at Torrey Pines for the year leading up to the U.S. Open there in 2005. “Golf can.”

Horton adds: “The competitive advantage of a municipal course is that they probably don’t have to pay the same real-estate taxes and the same taxes on their income that a private daily-fee golf course pays. But, clearly, there is a need for it in the golf hierarchy.”

While the argument that municipal operations have an unfair competitive advantage resonates with a contingent of people in the golf industry, Woodward doesn’t see it as a major issue, adding there’s room for everyone, municipal and private sectors alike.

Horton agrees, adding the only competitive advantage he sees is that government-run courses don’t have to pay the same real estate and income taxes as their public and private daily-fee brethren do. “Clearly, there is a need for (municipal facilities) in the golf hierarchy,” he says. “Somebody has to support the relatively inexpensive the golf course that is maintained to a lower standard so that people can learn the game and develop a love for the game and grow to the level of course at which he or she is most comfortable.”

The economics of it all

“I’m not making any money, but I’m not costing the taxpayers anything, either,” says Dennis Lyon, CGCS, who operates the seven-course golf division for the city of Aurora, Colo. “As long as we don’t cost the taxpayers anything, there’s not a big issue. Once a public course starts costing general-fund money, and they’re subsidizing golf courses and not hiring policemen or buying fire engines, then that’s a big problem.”

In the face of the country’s economic malaise, municipal courses are subject to most of the same challenges as privately owned facilities. And, as Richard Singer of NGF Consulting in Jupiter, Fla., puts it, “All golf – as in all politics – is local.”

According to NGF figures for 2007-2009, across America 141.5 18-hole-equivalent daily-fee courses were built, compared to 15 municipal tracks and 79 private clubs.

During the same period, 305 public, 22 municipal and another 40 private facilities closed. Total for the three-year period: 234.5 openings and 367 closures.

The net loss of municipal facilities: seven.

So whether the debate focuses on buying, selling or outsourcing management, it’s all going on with municipal courses, Singer says.

“Every instance is unique in how it has been set up, what kind of market they’re serving, what kind of fees they’re charging, what amenities they have, what expense situation is in place,” he says.

On the positive end for municipal operations, surveys show a lot of drop-down effect on the demand side. “People who used to play golf at higher-fee courses are dropping down to lower-fee facilities, and that often is municipal golf,” Singer says. “So, in some cases, they’re doing a little better on the revenue side.”

Also, Beditz points out that the 1960s golf-construction boom was in public golf – much of it government-owned. The reason municipal golf is so affordable is all the courses built in the 1960s no longer have debt to pay off. In contrast, he says the new courses built with the high-end client in mind and to cash in on the mythical boom are now facing the same difficulties as their daily-fee counterparts.

Meanwhile, more communities are farming out management of their municipal courses.

The trend, says Mike Hughes, executive director of the National Golf Course Owners Association (NGCOA), is for cash-strapped municipalities to leasing out to private operators. This trend has accelerated since the economic downturn.

“Municipalities running at deficits are looking for ways to close that budget gap,” he says. “And that includes the privatization of a lot of different kinds of operations, including golf.

“Nobody’s done a quantitative analysis,” he adds. “But intuitively people know private operators are generally more efficient and can at least staunch the losses they are experiencing.”

The industry is seeing a move toward some type of outsourcing, privatization-type arrangements, agrees NGF Consulting’s Singer. “Obviously the cost structure and future liabilities with regard to health care and union arrangements and all these things on the expense side definitely impact municipal golf,” he says. “A lot are opting toward full-service agreements, bringing in a management company to run the entire operation, either for a fee from the municipality to the company or the other way around, with a lease where the company pays the municipality for the right to operate the course. You also see shorter-term, specific agreements that involve F&B, pro shop, that type of thing.”

The pendulum swings back and forth, Singer says. “Twenty years ago that was the craze,” he says. “Then in the 1990s and this last decade it seemed to swing back the other way, with municipalities self-operating. Now they’re swinging back in the opposite direction.”

There are positive and negative aspects in hiring management companies to run a golf facility, Woodward says. For instance, facilities that are run by a management company have a “different spin,” he says.

“The city loses some control,” he says. “But, all in all, they can structure the agreement so that the city maintains control of the fee structure to provide the affordable golf it wants for its residents.

“Plus, a management company can come in with resources to fix up the course and make it competitive from a conditioning standpoint,” he adds. “A lot of municipalities shop out the pro shop and food-and-beverage, but maintain control of the maintenance, fee structures and policies. That model can work.”

From Pennsylvania to Colorado

In some cases, like the Township of East Hempfield, Pa., management companies are eschewed even while officials seek advice on golf course operations.

In 1989, East Hempfield bought a previously private facility for the open space and to protect a major underground aquifer. Four Seasons Golf Course hosted 45,000 rounds a year in its heyday, but that figure has declined to 35,000, says Head Golf Professional Craig Hall.

“I don’t have a sound reason for it, but the board of supervisors opposes hiring a management company,” says Town Manager Bob Krimmel. The debt service of $600,000 a year should be paid off in 2011, but he says the course isn’t earning enough to pay that service.

“We’re bringing in a consultant to help us look under some rocks, see what we can do better, what our player niche is, who they are and what we can do to encourage more of it,” Krimmel says.

Meanwhile, Gypsum, Colo., a town of 6,200 bought Cotton Ranch Golf Course last December, not for the open space or even to provide municipal golf in particular. Gypsum bought the $7.5-million, Pete Dye-designed track for a mere $2.5 million to protect home values. According to Town Manager Jeff Shroll, the bank that owned the property did not intend to reopen the course.

“From our perspective, if that course failed, housing would plummet and our overall tax base with it,” he says. “Plus, we could put it in our quiver of recreational opportunities.”

The public, Shroll says, has shown overwhelming support. “They’re not happy with the feds over their ridiculous bailouts, so we were nervous,” he says. “But this has no comparison with what the federal government is doing. Most people are smart enough to know it was a good move, protecting the town tax base and their neighbors.”

Helping calm any storm is the $49 fees, which includes a golf cart. “All other places around here are $30 to $150 higher than us,” Shroll says. “We think our model will attract a lot of people.”

Municipal courses may be doing better, but Singer says you have to look at it from the revenue and the expense sides. “On the revenue side, yes, some of them are doing better, although not all,” he says. “On the expense side, particularly with the self-operating munis, it is much more difficult for them to cut costs than the private sector. So the net may not be any better for the public sector.”

So how are municipal courses’ finances comparing to their daily-fee compatriots? “I’ve heard of golf courses that have gone under and been turned into condos,” says Wooward, “but not any municipal structure.” GCI

Mark Leslie is a freelance writer based in Monmouth, Maine. GCI

Explore the May 2010 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

- Applications open for 2025 Syngenta Business Institute

- Smart Greens Episode 1: Welcome to the digital agronomy era

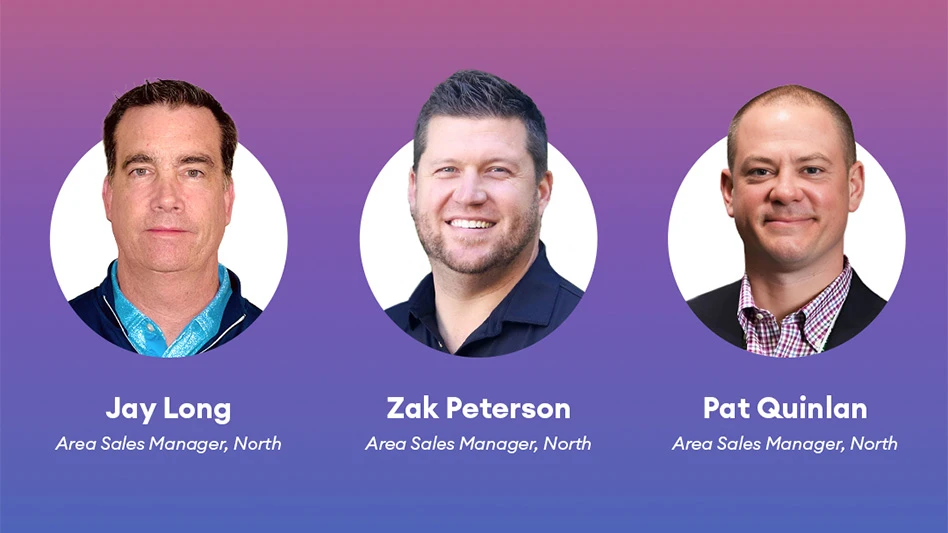

- PBI-Gordon promotes Jeff Marvin

- USGA investing $1 million into Western Pennsylvania public golf

- KemperSports taps new strategy EVP

- Audubon International marks Earth Day in growth mode

- Editor’s notebook: Do your part

- Greens with Envy 66: A Southern spring road trip