sponsored by

As this year’s State of the Industry report once again shows, the golf industry continues to evolve. As it does, Textron Specialized Vehicles is changing with the times to better serve you.

2017 was a transformative year for us, with E-Z-GO®, Jacobsen®, Cushman® and Textron Fleet Management coming together under one umbrella — Textron Golf. We are uniquely positioned to be a single-source solution for a course’s equipment needs, from E-Z-GO golf cars, to Cushman utility and hospitality vehicles, to Jacobsen turf-care equipment. We offer the industry’s largest sales and service network to golf facilities worldwide, ready at a moment’s notice to help you work more efficiently, reduce your operational costs, and improve the golfer’s experience at your course.

2017 also showed Textron Golf’s continued commitment to innovation with the launch of several new products across our brands and product lines. Jacobsen introduced its SLF530 superlight fairway mower, providing Jacobsen’s unparalleled quality of cut while exerting less ground pressure than a golfer’s foot. Our Textron Fleet Management solutions allow course operators to track their equipment fleets, and monitor maintenance crews, golfers’ pace of play and other course activities in real time, while providing their golfers an enhanced on-course experience.

And we became the first manufacturer to launch lithium-powered golf cars at fleet scale, introducing our ELiTE™ series of E-Z-GO golf cars. These vehicles are activated by exclusive Samsung SDI zero-maintenance batteries backed by an industry-leading five-year, unlimited amp-hour warranty. This proven technology reduces your electric bills and labor costs — with no compromises to the golf car’s performance and daily range.

We are proud to sponsor this year’s State of the Industry report and expect that you will find it informative and helpful as you plan for the future. As the industry changes, you can count on Textron Golf to continue to evolve with it, providing a steady drumbeat of new and improved products and services to help you adapt to change, better serve your customers, and grow a larger, more profitable business.

Sincerely,

Michael R. Parkhurst

Vice President, Golf Textron Specialized Vehicles Inc.

We would like to take a moment to wish you all a Happy New Year! As we look back on a successful 2017, all of us at Nufarm are entering 2018 with great enthusiasm. This year is another excellent opportunity to bring you new, innovative products that will deliver better outcomes in the year ahead.

We’re thankful for the success of our recent launches, including: Anuew® — a PGR that has quickly become part of the turf quality management puzzle; and Pinpoint — an impressive new Dollar Spot solution. We’re also pleased to have many new solutions coming on the horizon.

One new innovation we’ll spotlight in early 2018 is a proprietary turf fungicide that combines two FRAC active ingredients in a convenient pre-mix formulation to help golf course managers gain traction in fighting 19 challenging diseases and algal scum. This fungicide is labeled for use on greens, tees, fairways, and aprons and intended to serve as a top-performer in your disease control and resistance management program, improving flexibility and saving you time. We look forward to sharing more with you in the coming days.

As a trusted partner to the golf course industry, Nufarm is committed to innovation that will bring you the tools that you need. We will continue to evolve so that you may continue to evolve, and we look forward to supporting your journey.

Cam Copley

Golf National Accounts Manager

With remnants of the Great Recession still stalling parts of the golf business, Henry DeLozier exuded calm on April 12, 2016, using his forum as the leadoff speaker at the GCI Technology Conference to describe golf’s fortuitous spot.

An audience consisting of course superintendents and industry professionals listened to DeLozier use words such as “bullish,” “prosper,” and “optimistic,” strong language considering the cuts and closings the industry had endured. DeLozier, a principal at Global Golf Advisors, is a golf advocate who passionately celebrates the game’s values and career potential. He’s also been humbled by golf’s tumbles, a combination of uncontrollable global economic factors and self-inflicted follies.

Nineteen months after his presentation at Carolina Golf Club in Charlotte, a magazine editor reminded DeLozier of his upbeat projections. He embraced golf when others flocked elsewhere, yet his humility resonates. “I try to be a realist,” he says. “I try to understand that not everything will work to the advantage of golf, but I’m very optimistic for the future of golf.”

A soaring stock market, decreasing unemployment and a solid base of committed golfers are producing the highest level of operator confidence since the mid-2000s. Whether you’re a management company executive in Scottsdale Ariz., or superintendent in Pinehurst, N.C., a few metrics and emotions are likely working in your favor entering 2018.

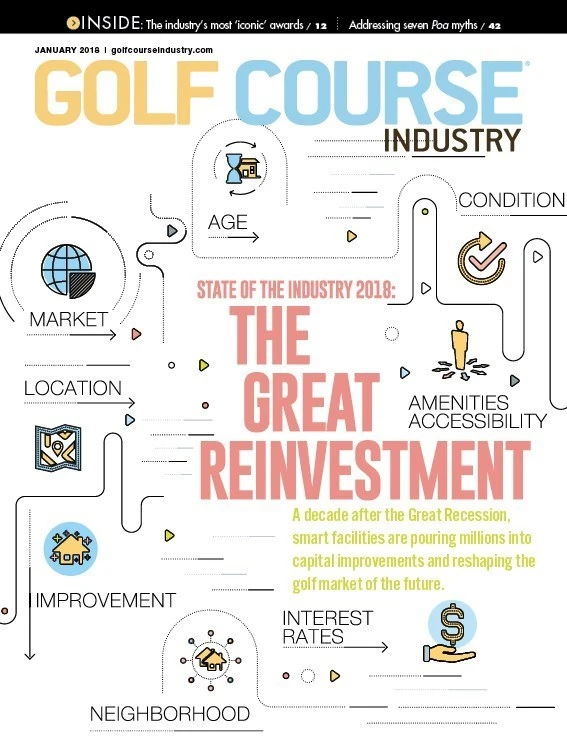

GCI conducted its annual State of the Industry survey of superintendents and partnered in the American Society of Golf Course Architects/Sports & Leisure Research Group Golf Facility Market Trend Watch in late 2017. Both reports indicate substantial funds exists for capital improvements, meaning golf’s current cycle might be remembered as the Great Reinvestment.

The average maintenance budget is storming toward $1 million. Thirty-three percent of the more than 450 superintendents who responded to the GCI survey reported non-capital operations budgets exceeding $1 million, bringing the average maintenance budget to $911,705, the highest average since GCI started tracking superintendent data in 2012. Increased labor costs are a major reason for the spike. Labor accounts for 60 percent of a facility’s maintenance budget, according to the survey. But operators’ willingness to provide the necessary resources to produce splendid course conditions are also contributing to larger ledgers.

“We are putting money back into the golf course, and it’s not just labor and things that aren’t controlled by us,” Troon senior vice president of science and agronomy Jeff Spangler says. “We are also increasing maintenance budgets, changing our fertilizing practices a little bit by getting more aggressive again and providing a little more preventative maintenance on chemical programs. There’s greater stability and we are putting money back into the golf course. Maintenance budgets for us have increased every year for a while now, including on all the individual line items in our budget.”

Spangler works for the industry’s largest management company. Troon manages around 270 facilities and its portfolio includes courses in all four major categories: private, public, municipal and resort. Each category faces distinct challenges – municipal courses must cope with bureaucratic intervention while private clubs joust for younger members – but Spangler says, in general, the industry “has rounded the corner to some degree.”

Climbing dollars for capital

The volume and scope of capital improvements represents the biggest swing at many facilities. The average capital improvement budget for 2018 is $313,042, a nearly 100 percent jump from an average of $160,724 in 2012, according to the GCI survey. Stagnant facilities are anomalies, as 80 percent of superintendents report they are budgeting for capital improvements. “I think 2018 is going to be a great year for golf course architects and builders,” DeLozier says.

Architects, a group battered by the Great Recession, are experiencing more demand for their services, with 83 percent reporting increased or flat renovation revenue over the past 24 months, according to the ASGCA-SLRG study. The next 24 months should be busier, as 90 percent are expecting increased or flat renovation revenue.

Builders are also in a growth mode. Landscapes Unlimited experienced 15 percent construction growth in 2017, says founder and CEO Bill Kubly. Projections are conservative because the company doesn’t book work until contracts are officially signed, but Kubly expects the construction side of the business to grow by another 5 to 10 percent in 2018. Landscapes Unlimited also manages and own courses. The company added a contract maintenance division in 2017. “I couldn’t be more positive right now,” Kubly says.

Competitive desires spur enhancements among the top 25 percent of clubs, DeLozier says, thus the current rise of $1 million or more renovations, especially in the Southeast, where the average projected 2018 capital improvement budget is $579,159. Examples of courses executing bold projects during the Great Recession proved rare. Pinehurst Resort restored its No. 2 famed course and improved its clubhouse in the middle of the Great Recession, business decisions director of golf course and grounds management Bob Farren says benefitted the resort when the economy started improving. Pinehurst recently embarked on another phase of major capital improvements, which includes the opening of a nine-hole short course and renovation of its No. 4 course.

“We’re very optimistic about things,” Farren says. “What we have been able to take advantage of with our resources from our ownership family is that we invested a lot during the downturn. We did a lot of those investments when a lot of people were hunkering down a lot, which really put us on the front end as we have come out of and continue to come out of the downturn.”

Delaying capital improvements is a common operator reaction to a downturn, says KemperSports CEO Steve Skinner, whose company manages more than 130 golf facilities. “You can get away with it for a year or two,” he adds, “but in the long term you need to invest in the facility.”

While major renovations at elite facilities generate buzz, courses pursuing deferred capital projects or purchases are major contributors to the golf economy. Nearly half of all facilities (48 percent) are planning bunker renovations in the next three years, according to the GCI survey. That follows multiple years of steady bunker improvements. “There’s pent-up demand from the really higher-end clubs that started doing bunker work three, four years ago,” Kubly says. “Now it’s the maybe middle market golf courses saying, ‘We need that too.’ It’s keeping up with the Joneses – and the economy is strong.”

But the Great Investment also involves hundreds of facilities planning to upgrade drainage (43 percent), cart paths (41 percent) and existing irrigation systems (37 percent) within the next three years. Even 12 percent of courses are expected to improve their maintenance facilities, operational support structures seldom seen by customers.

And let’s not forget equipment. Nearly half (49 percent) of capital spending in 2018 will include equipment purchases, so fresher coats of green, orange and red will be spotted in all four regions. “The message I hear is that people are getting comfortable with the new stability in the industry,” Textron Golf director of product development and strategy Matt Zaremba says. “Once things get stable, you can feel more confident with what tomorrow will look like and courses are willing to invest and improve and contribute more to their business when conditions are stable.”

Better courses, better morale

Bunkers with improved drainage and sleeker equipment should boost another group rattled by the Great Recession: superintendents and their teams. A decade of tightening budgets and deferred projects convinced hundreds, if not thousands, of highly trained professionals to abandon the industry.

Those who stuck around are now witnessing unfamiliar sights such as the delivery of new sand, equipment and chemistries. The deliveries are tangible signs of the Great Reinvestment. “Who doesn’t like that new car smell?” Farren says.

Increased facility spending might mean more scenes like the one at last year’s Carolinas GCSA Conference & Show. Instead of struggling to fill available booths, the association scoured the Myrtle Beach Convention Center for additional room, using a portion of the lunch area to satisfy the 217 companies who occupied 407 booth spaces. Both totals are the highest since 2008. Carolinas GCSA executive director Tim Kreger attributes the current renovation frenzy to the show’s 2017 growth. Besides more commerce, Kreger has observed improved morale.

“We feel like our members have felt the brunt of a lot of cuts over the last couple of years and have suffered hardships where they have lost jobs or taken pay cuts to stay employed,” he says. “Anything we can do to see some positive energy come back around, whether that’s personal growth and improvement or health care improvement or to hire some folks to help so they are not working so hard, are all positives.”

As signs point toward the positive energy continuing in 2018, a loaded question emerges: Is the golf industry back?

The number of golfers has decreased from 30 million in 2006 to 23.8 million in 2016, according to National Golf Foundation data. But DeLozier says the industry can grow without expanding its customer base because mobile jobs that can be performed anywhere, including on a golf course, shrink the separation between work and recreation. Expanded and creative programing are other ways to increase revenue without expanding the base of golfers, Skinner says.

Enhanced products could be another route to revenue growth. A Global Golf Advisors analysis created for the City of Los Angeles municipal golf system, which includes seven 18-hole, four nine-hole and two par-3 courses, revealed that customers on limited golf budgets are willing to spend a few extra dollars to play an enhanced course. The ASGCA-SLRG study found that course renovations are the most coveted enhancement by public and private facility operators.

In his own backyard, the competitive Phoenix-Scottsdale market, Spangler says customers have responded “really well” to renovations at Troon North’s Monument course. Renovations included returning green complexes to their original shapes and sizes, resurfacing greens and collars, and renovating bunkers.

“You feel like there’s life back in your facility,” Spangler says. “But it’s not just golf course supervisor staff or the superintendents. It’s the members, it’s the players that are coming to play the golf course. Everybody senses that this tide is rising and getting excited about it.

“It’s not like back in the day when everybody was playing golf with a corporate platinum card and expensing it and there were 250 courses built a year. But the industry is certainly moving forward and everybody can sense it in all aspects of the operation, on the budget side, on the renovation side, the morale of staff and the demand for tee times. It’s nice, consistent growth.”

Explore the January 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Golf Course Industry

- Schaffer’s Mill turns to Troon for management

- Talking Turf Weeds 13: Talking seasonal change with Heidi Burgess and Paul Marquardt

- Beyond the Page 65: New faces on the back page

- From the publisher’s pen: New? No way!

- Indiana course upgrades range with synthetic ‘bunkers’

- Monterey Peninsula CC Shore Course renovation almost finished

- KemperSports and Touchstone Golf announce partnership

- PBI-Gordon Company hires marketing manager Jared Hoyle